Eidl loan amount calculation

COVID-19 EIDL Advance Grant of 10000 or less. Currently up to 150000.

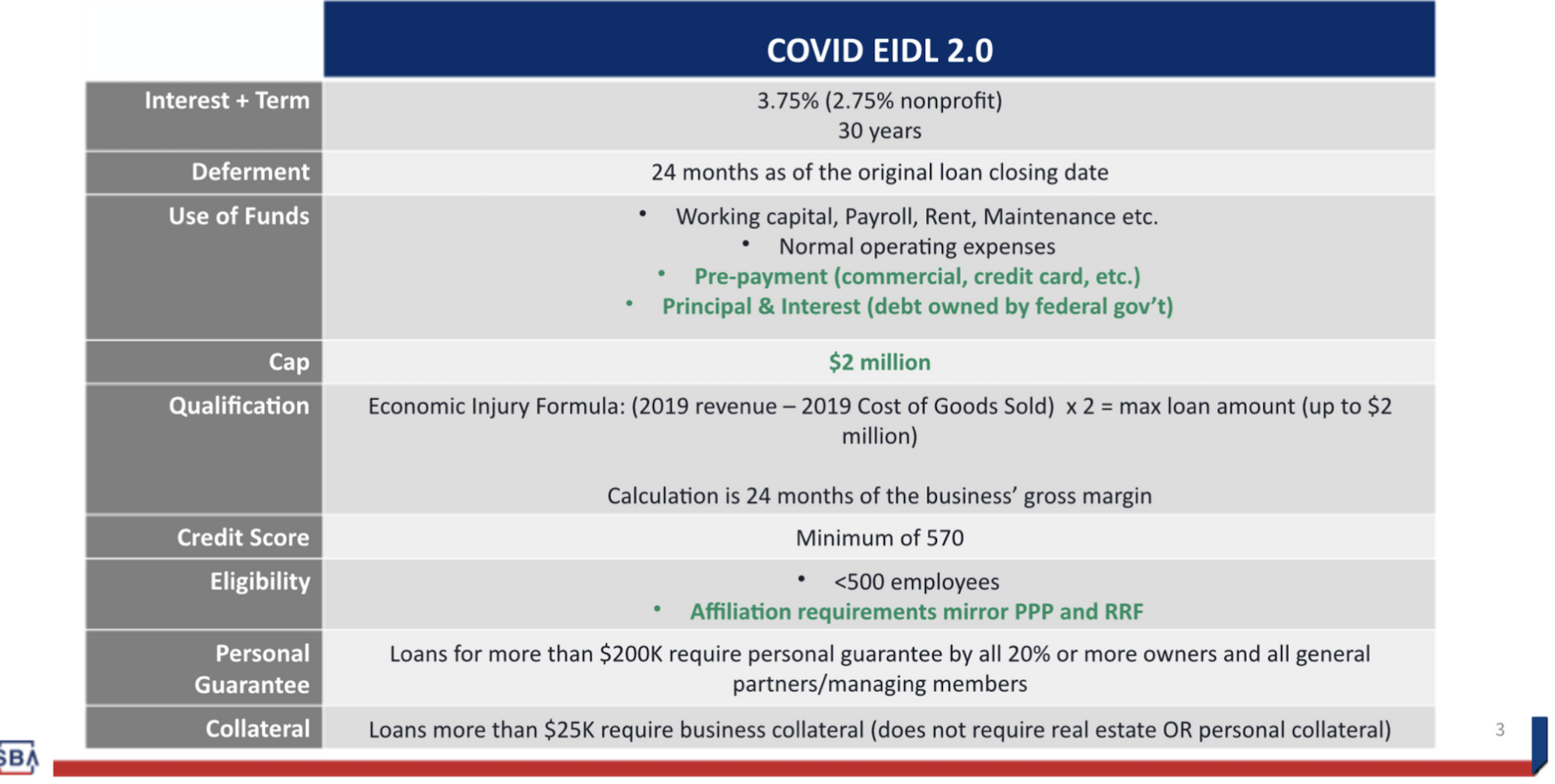

Exclusive 2m Eidl Loan Cap Go Live Details

Grants awarded under the program may not be used to re-pay or pay down any portion of a loan obtained through a federal COVID-19 relief.

. 355S or M-990T and received an Economic Injury Disaster Loan EIDL grant awarded pursuant to. The provision also allows you to use prior year net earnings from self-employment in the calculation of the average daily self-employment income if the prior year net earnings help you arrive at a higher average daily self-employment income. COVID EIDL loans are different from regular Disaster Loan Program loans.

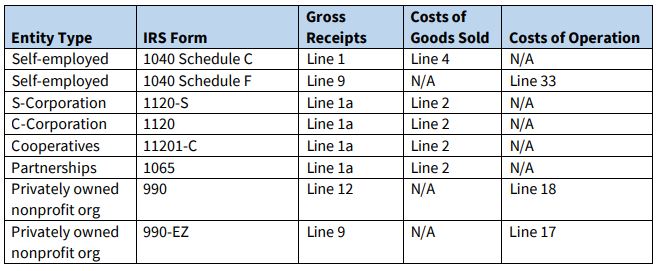

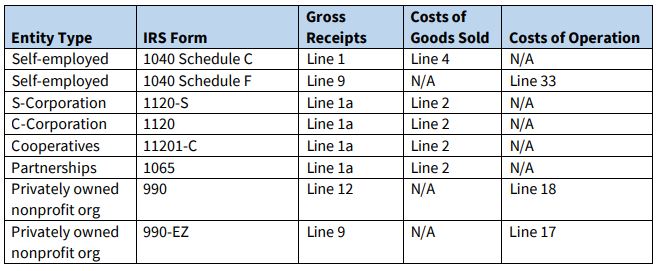

Previously when the PPP loan calculation was based off of net income the amount you could take as a sole proprietor business owner was called owner compensation replacementIt was calculated using your net income as reported on line 31 of your Schedule C multiplied by 2512 or 0208. Conventional lenders use a calculation known as loan-to-cost for commercial construction loans. The EIDL loan amount was based on the amount of economic injury the individual sustained as.

Obtaining Revenue Information from Sales. COVID EIDL stands for COVID-19 Economic Injury Disaster Loan. Per AB 80 California law conforms to the federal law regarding the treatment for an emergency Economic Injury Disaster Loan EIDL grant under the federal CARES Act or a targeted EIDL advance under the Consolidated Appropriations Act 2021.

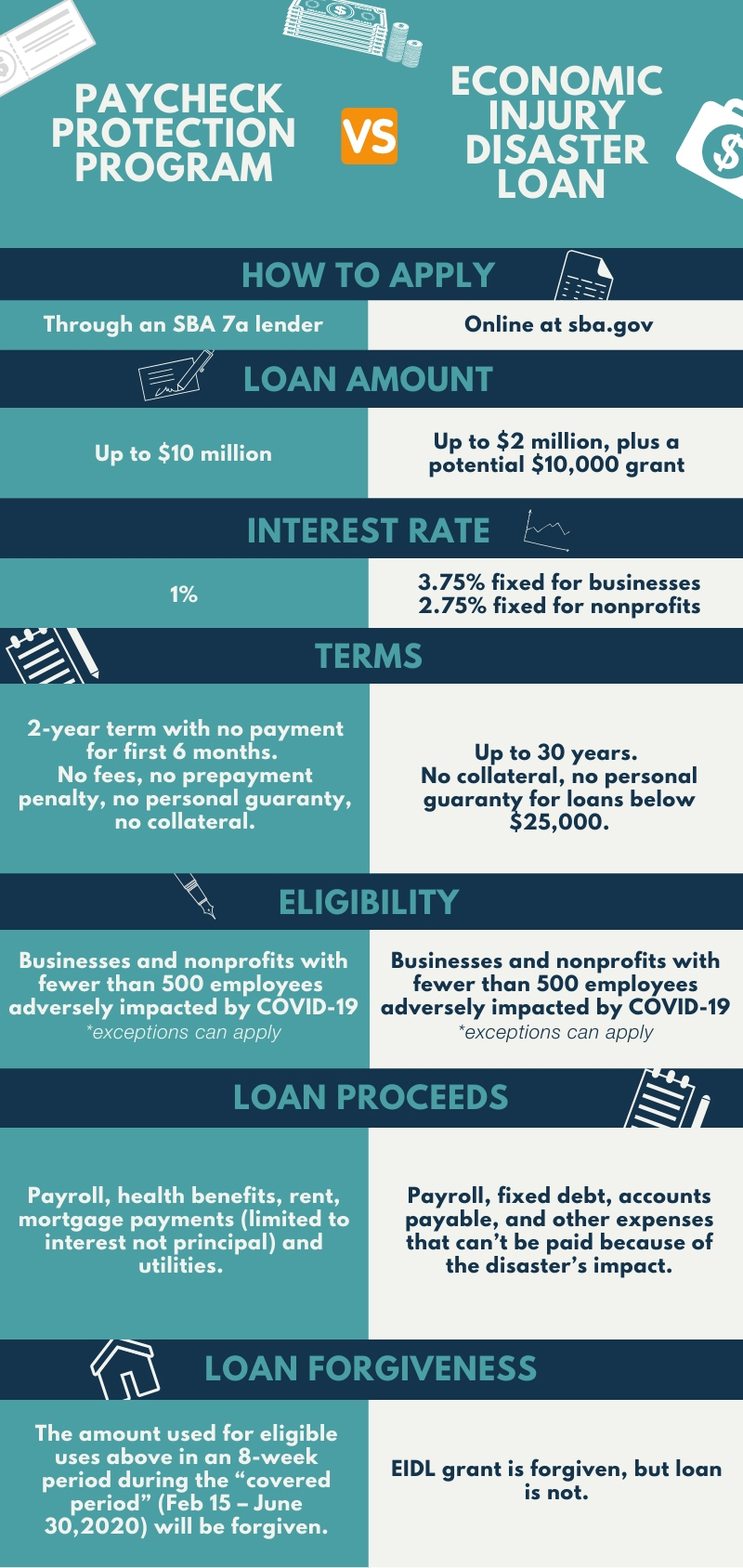

If the EIDL loan is used for payroll costs and the EIDL loan was funded between January 31 2020 and April 3 2020 the PPP loan must be used to refinance the EIDL loan. In this example they could expect to see their entire loan amount forgiven. The loan-to-cost ratio is calculated by dividing the total amount of the loan requested by the total project cost.

Under the CARES Act a PPP loan recipient is eligible for loan forgiveness in an amount spent by the recipient during an 8-week period after the origination date of the loan on certain payroll mortgage interest rent or utilities payments. Start your business in 10 steps. An EIDL loan may not be refinanced with a PPP loan when the PPP borrower received the EIDL loan before January 31 2020 or after April 3 2020.

To supplement lost revenue resulting from COVID-19. Then using your PPP loan papers you can figure out how much you can get in ERCs. _____ Employees at Time of Forgiveness Application.

The frequency with which payroll is paid to employees is. If your EIDL loan was not used for payroll costs it does not affect your eligibility for a PPP loan. If your EIDL loan was used for payroll costs your PPP loan must be used to refinance your EIDL loan.

Passage of the PPP Flexibility Act of 2020 on June 5 2020 made important changes to PPP loan forgiveness that extended the amount of time you had to spend the money lower the percent that must. Payroll and Nonpayroll Costs. Total expenses calculation versus proposed grant amount will be based on business expenses reported on 2020 federal tax return submitted by the applicant.

On pages 22 and 23 of the IRS Form 941 instructions there is a spreadsheet for calculation of the ERC for 2021 that can be used to compute the ERC amount once wage totals for the quarter have been determined. Instructions for PPP Loan Forgiveness Calculation Form 3508EZ Business Legal Name BorrowerDBA or Tradename if applicable Business TIN EIN SSN. Keep in mind that with EIDL the borrower doesnt ask for a specific loan amount.

However at least. This may be increased at a later date. Proceeds from any advance up to 10000 on the EIDL loan will be deducted from the loan forgiveness amount on the PPP loan.

When they applied for forgiveness they noted that within 24 weeks of their loan funding they had spent and properly documented 60000 on allowable payroll costs and 40000 in allowable other costs. Instead the SBA will calculate it based on its formulas for determining economic injury The following examples come from the section of the SOP page 186-187 abbreviated here that relates to calculating economic injury. COVID-19 Economic Injury Disaster Loans EIDL Purpose.

In response to the COVID-19 pandemic SBA was given the authority to make low-interest fixed-rate long-term COVID EIDL loans to help small businesses and. PPP Loan Di sbursement Date. Not sure where to start.

To be eligible for the Employee Retention Credit you must have sales income from 2019 to 2020. A seasonal employer that elects to use a 12-week period between May 1 2019 and September 15 2019 to calculate its maximum PPP loan amount must use the same 12-week period as the reference period for calculation of any reduction in the amount of loan forgiveness. The Florida state rate for tipped employees which is 698hour is more than three times the.

Owner compensation share. Payroll expenses fixed debts accounts payable other expenses. Businesses can use Employee Retention Credit calculation spreadsheet to make their job easier.

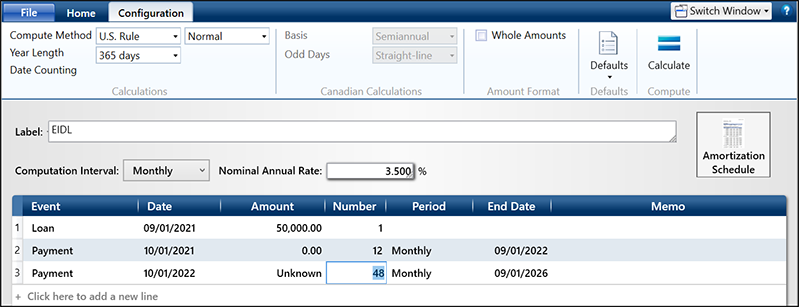

Enter the same information as on your Borrower Application Form SBA Form 2483 or lenders equivalent. Up to 30 years. And an EIDL loan is not required.

You must gather information on any PPP loans you have taken including the date the PPP loan was granted and the loan amount. Form 568 Limited Liability Company Tax Booklet. 375 or 275 for non-profits.

Employees at Time of Loan Application. Lets say for example a business is requesting a loan of 190000 for a project with a total cost of 200000. Borrower applied for and received a 100000 PPP loan.

COVID 19 Economic Injury. Instead you must apply for forgiveness of your PPP loan using SBA Form 3508. Floridas voters recently passed Amendment 2 which increased Floridass minimum wage to 1000hour and will continue to increase the minimum wage incrementally until it reaches 1500hour which is almost double the federal minimum wage of 725hour.

Eidl Loan Up To 2 Million Homeunemployed Com

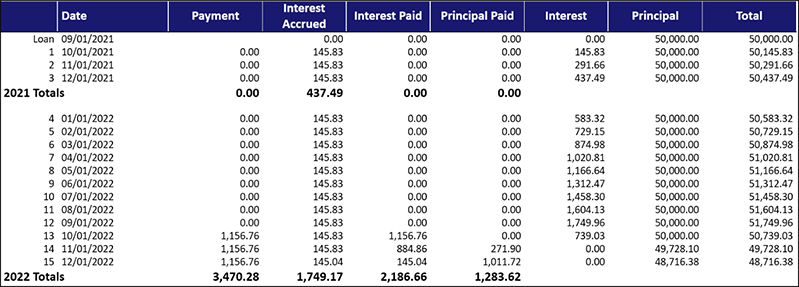

Economic Injury Disaster Loans Eidl Timevalue Software

One Of The Most Significant Features Of The Sba S Paycheck Protection Program Is The Connec Loan Forgiveness Small Business Success Small Business Consulting

New Sba Targeted Eidl 10 000 Grant Application Step By Step Instructions

Sba Eidl Loan Vs Sba Paycheck Protection Program Tmc Financing

Easy Instructions On How To Fill Out The Eidl Gross Receipt Chart Youtube

Targeted Eidl Grant How To Calculate Gross Receipts Youtube

How To Calculate Your Eidl Loan Amount Lantern By Sofi

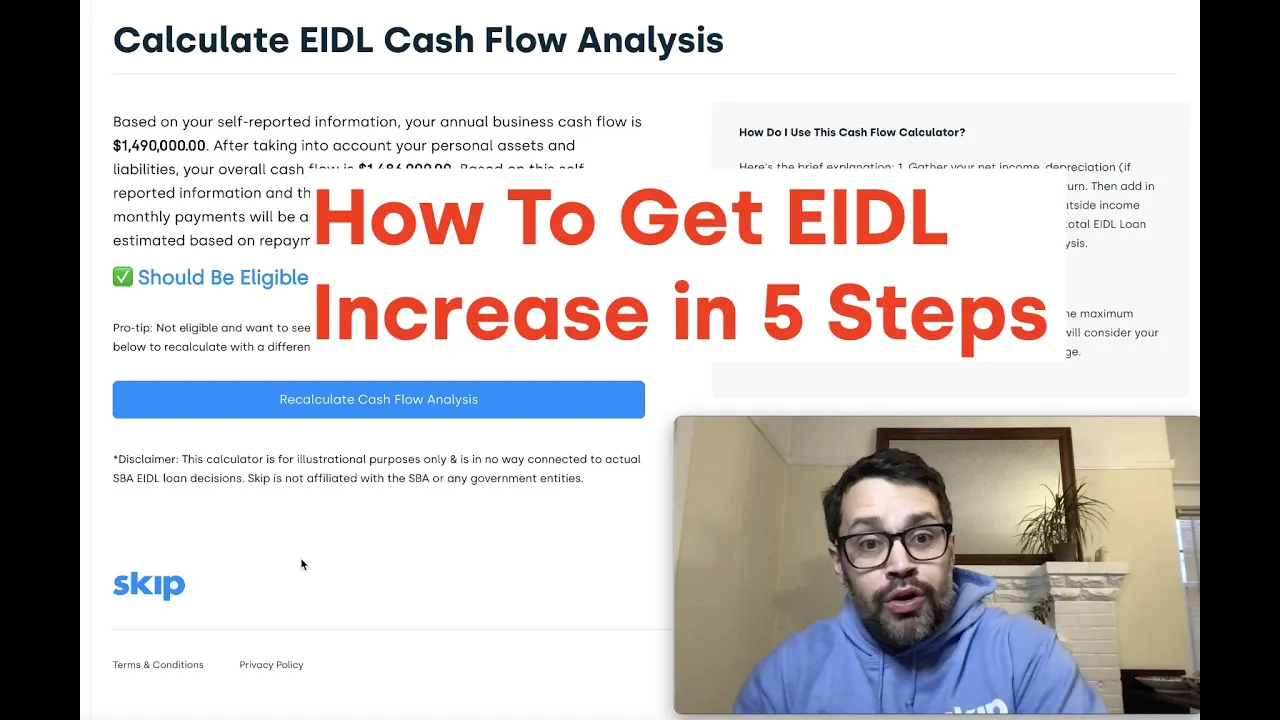

How To Get An Eidl Increase In 5 Steps

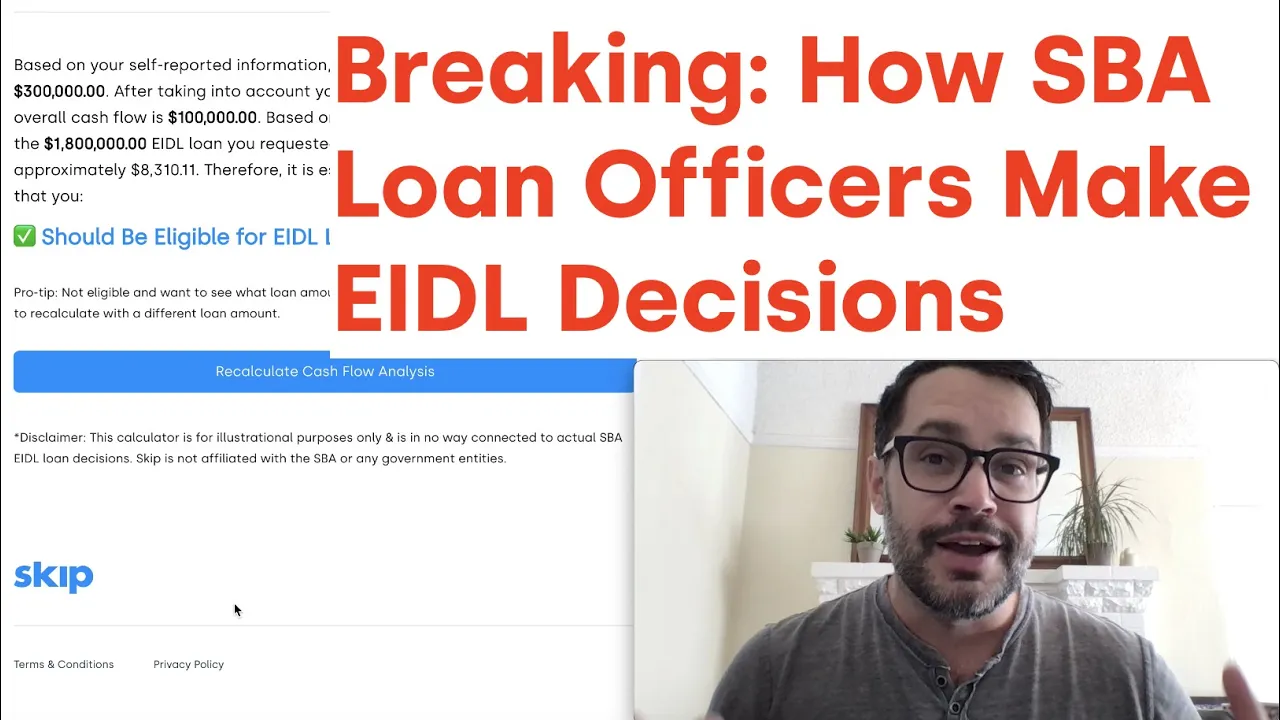

Breaking Here S How Sba Loan Officers Make Eidl Decisions

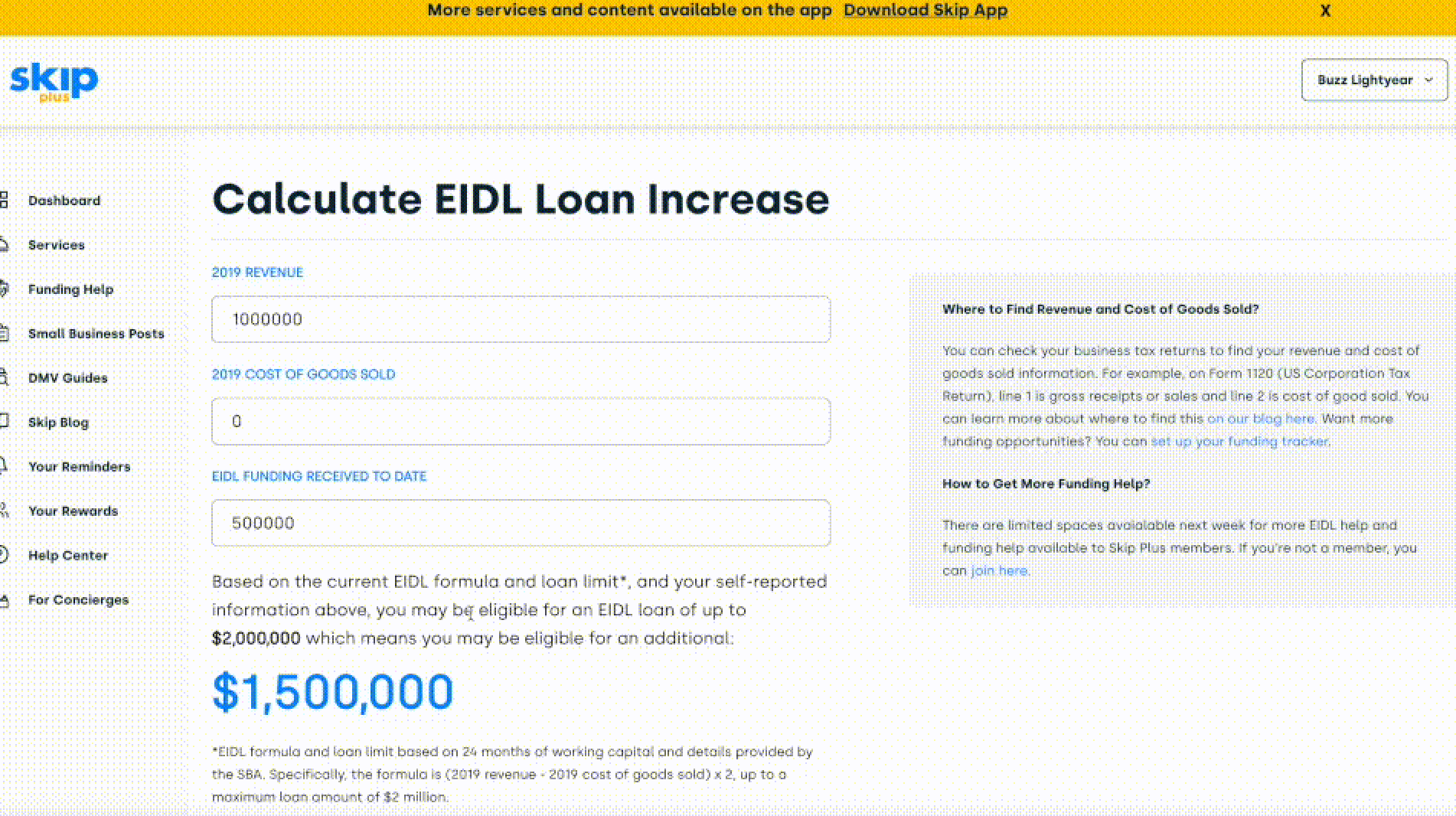

Here S How To Calculate Your Potential Eidl Loan Increase

Eidl And Collateral Your Questions Answered Bench Accounting

How Much Eidl Loan Increase Can I Get 2021 Amount Of Sba Eidl Loan

![]()

Check Potential Eidl Loan Increase Amount Progress

Economic Injury Disaster Loans Eidl Timevalue Software

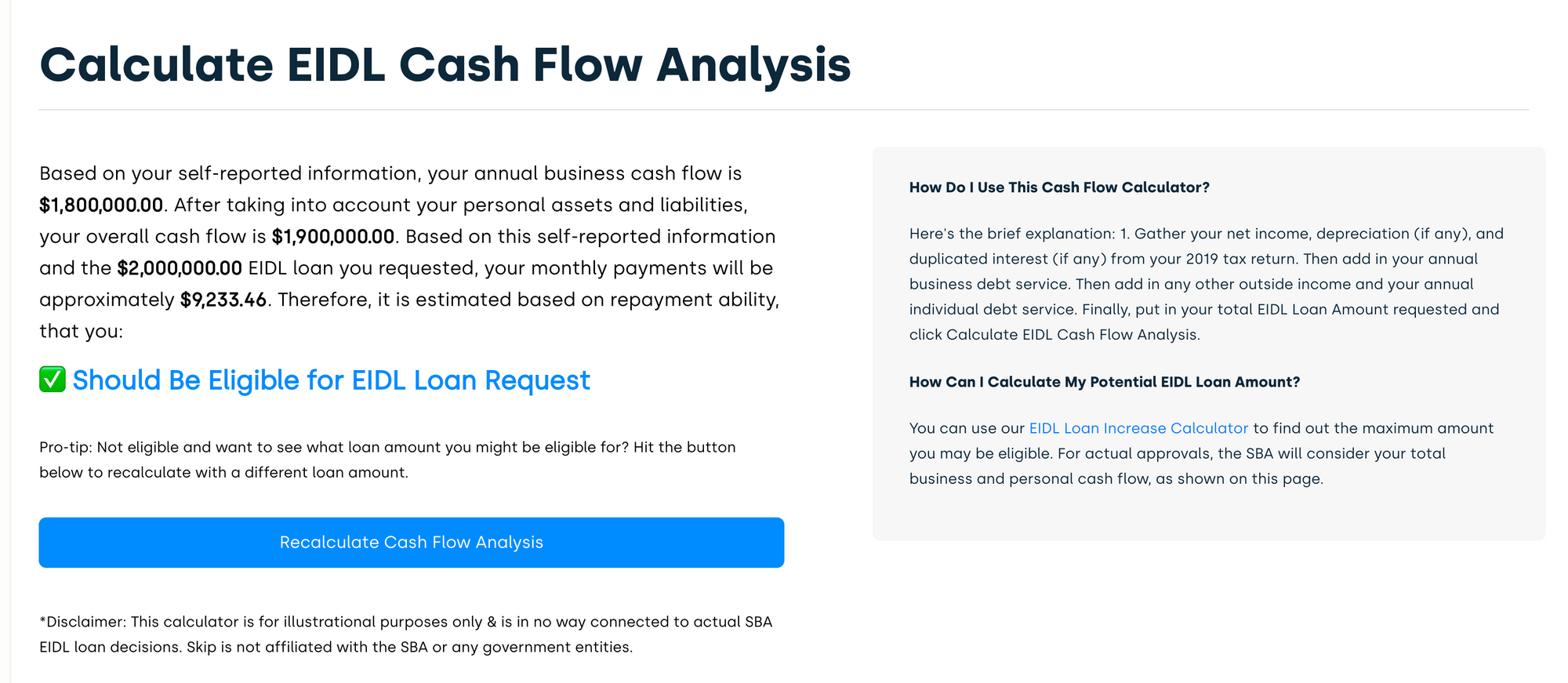

How To Check Eidl Approval With Cash Flow Calculator

Targeted Eidl Grant How To Calculate Gross Receipts Youtube